Weekly Insights for Dubai Property Investors: December 6, 2025

- Stephen James Mitchell MBA

- Dec 6, 2025

- 5 min read

Updated: Dec 9, 2025

The UAE enters this week on a solid footing: non‑oil activities now account for 77.5% of GDP, hotel establishments have welcomed over 23.27 million guests so far in 2025, and the country has registered more than 220,000 new companies since January — underlining strong economic diversification.

In Dubai’s real estate market, November recorded 19,019 transactions worth AED 64.7 billion, bringing the full‑year total to AED 624.1 billion. Off‑plan sales remain dominant; 54% of residential deals in H2 2025 were cash-based, reflecting robust liquidity.

Meanwhile, the commercial real estate segment across the UAE is seeing rising occupancy and rental pressure, and in Abu Dhabi, Q3 posted a 76% year‑on‑year increase in residential transactions.

This week’s updates deliver a data‑rich snapshot of where demand is concentrated — and where the structural value lies as we move toward 2026.

If you’re looking to capitalise on these structural shifts — whether through income-generating commercial assets or high-demand off-plan launches — get in touch now. I’ll provide a curated shortlist of resilient, high-conviction opportunities backed by real market data and 18+ years of on-the-ground experience in the UAE.

UAE Marks National Day with Exceptional Economic Momentum

This week, the UAE celebrated its 54th National Day with data that underscored its status as the region’s leading economy. Real GDP is projected to grow 4.8% in 2025 according to both the IMF and World Bank, with non-oil activity now comprising 77.5% of GDP.

Key milestones from the year include:

Foreign Trade: AED 1.7 trillion in non-oil trade during H1 2025 (up 24.5%)

Tourism Surge: AED 257.3 billion in tourism GDP contribution (+13%) and 23.27 million hotel guests

Business Formation: 220,186 new companies and 36,000 trademarks registered

FDI Record: AED 167.6 billion (USD 45.6 billion) in inflows, placing the UAE 10th globally

Vision 2031 and the National Investment Strategy 2031 are driving these numbers. But so too is the digital push: the UAE now plans to produce 60 trillion AI tokens and has already saved AED 500 million in energy costs using AI tools.

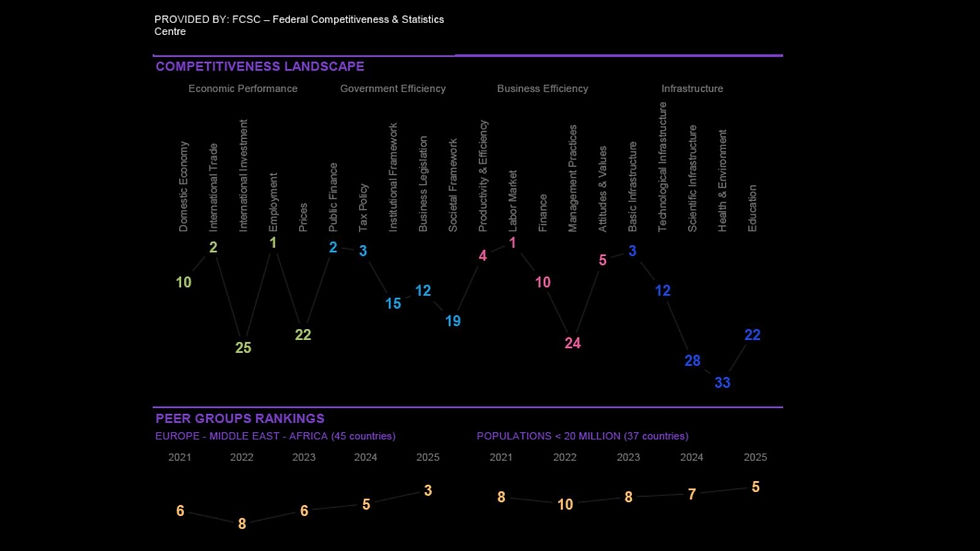

The UAE secured 5th place globally in the 2025 IMD World Competitiveness Ranking, standing out for its streamlined governance, resilient economy, and pro-business policies. The country also ranked 1st worldwide in employment and labour market strength, 2nd in economic performance, and third in business efficiency — a reflection of its fast‑advancing tech ecosystem.

$4 Trillion Forecast: Tracking Growth and Risk in the Arab World

A new report from the Arab Investment & Export Credit Guarantee Corporation predicts Arab GDP will rise 5.6% to $4 trillion in 2026, despite mixed indicators for 2025. While purchasing power parity-adjusted GDP hit $9.8 trillion, real GDP grew just 1.7% due to lower oil prices and geopolitical risks.

Key data points:

Unemployment: Fell to 9.4% in 2025 and forecast to decline again in 2026

Investment: Up 5.2% to $864B in 2025, with 5.4% growth forecast in 2026

Budget Deficits: Widened to $95B in 2025 due to oil price dips

FX Reserves: Rose 3.4% to $1.2 trillion

The picture remains uneven, but key markets like the UAE and Saudi Arabia are driving most of the region's positive momentum.

Dubai Property Hits AED 624 Billion as 2025 Breaks Every Record

Dubai's real estate market continued its record-breaking streak in November, registering 19,019 transactions worth AED 64.7 billion. This pushed year-to-date figures to 197,263 deals valued at AED 624.1 billion, far ahead of 2024's full-year totals.

Notable trends include:

Off-Plan Dominance: 13,374 first-sale deals worth AED 41.4B

Apartment Sales: 15,905 transactions for AED 32.1B (+37.4% YoY)

Villas: AED 13.2B in sales, though unit count declined slightly

Commercial Sales: Soared 79.7% to AED 2.3B

Price/SqFt: Up 16.1% YoY to AED 1,755

JVC, Business Bay, Mina Rashid, and Dubai South led area-wise sales, while ultra-prime deals included a AED 203M apartment in Jumeirah Residences and a AED 110M Palm Jumeirah villa.

Commercial Real Estate Takes the Spotlight

Following the record-setting boom in residential property during 2021 and 2022, commercial real estate is now taking the spotlight — backed by stronger fundamentals, deeper demand, and more sustainable returns.

Other signs of a structural shift:

Occupancy Rates: 98% for Grade A space; DIFC stock pre-leased pre-handover

Price Growth: The Opus in Business Bay has crossed AED 9,000/sqft

Bay Square: From AED 2,200 last year to AED 3,500 this year

Almas Tower JLT: From AED 3,000 to AED 5,000 in <12 months

A full 54% of residential transactions in H2 were cash-based, and similar dynamics are supporting commercial stability. Triple-net leases, lower tenant turnover, and structural demand for office and retail space are helping commercial assets outpace residential in total ROI.

Explore commercial listings and insights at Mitchell’s Commercial Realty — featuring premium office and retail properties across Dubai, along with market intelligence to help you identify emerging trends.

Abu Dhabi, Northern Emirates Post Breakout Performance

Abu Dhabi continues to deliver outsized gains across residential and office sectors.

In Q3 2025 alone:

Residential Transactions: 7,154 (+76% YoY)

Off-Plan Share: 73%, led by Fahid Island and Al Hidayriyyat

Rental Growth: 11–13% YoY; prime offices nearly fully occupied

Office Rents: Surpass AED 3,000/sqm in ADGM

The Northern Emirates also saw significant growth:

RAK: +18% YoY prices, +12% rents, driven by Al Marjan projects

Sharjah: +12% sales prices, rising family demand

Al Ain: Stable growth with 10,500 new units planned

UAE Residents Still Bullish on Buying Despite High Prices

Property Finder’s latest survey shows 69% of UAE residents plan to buy property in the next six months, indicating strong confidence despite high prices:

Price Outlook: Only 40% expect a decline, showing limited speculation

Popular Price Bands: AED 1–2M range accounted for 37% of sales

Resale Share: 5,645 deals for AED 23.3B in November

Demand continues across all segments, with buyers showing a clear preference for stability and long-term ownership.

Liquidity, Mortgage Easing, and Market Resilience

As global monetary policy shifts from tightening to easing, Dubai is well-positioned to sustain momentum:

Cash Deals: 54% of residential transactions remain all-cash

UAE Mortgage Rates: Down to 3.75–4.99% as Central Bank eases base rate to 3.9%

Global Context: U.S. mortgage rates fell to 6.2%, supporting broader investor risk appetite

Unlike over-leveraged markets, Dubai’s fundamentals remain strong: digital systems, dollar peg, and high transparency are attracting institutional capital.

AI and Digital Economy: UAE Eyes 60 Trillion Token Factory

The UAE’s ambitions to become the "world’s factory of intelligence" are taking shape with plans to produce 60 trillion AI tokens via the Stargate data center. Already operating at 200MW and set to scale to 1GW, Stargate will be one of the world’s largest AI-focused infrastructures.

AI-driven energy savings have already topped AED 500M. This is part of a broader digital leap that includes:

450,000+ programmers active in UAE

Global cybersecurity hub launched with Google

$1B initiative for AI in Africa

Strategic Takeaway: Stability with Forward Momentum

The message this week is clear: while other regions brace for slowdown, the UAE continues to chart a course of controlled expansion, digital transformation, and investor-led growth. From property to policy, from infrastructure to innovation, the trends all point in the same direction.

Resilience isn’t just holding steady. It’s knowing where to steer next.

Let’s Talk

If you’d like to unpack where the most resilient opportunities are emerging — in stabilised residential areas or income-generating commercial zones — I’m happy to share a focused, data-driven shortlist based on your investment goals.

📞 No pressure, no sales pitch—just a focused, informed conversation about your investment goals. Let’s talk.

Comments